What the hell happened with Bitcoin this weekend?

TL;DR

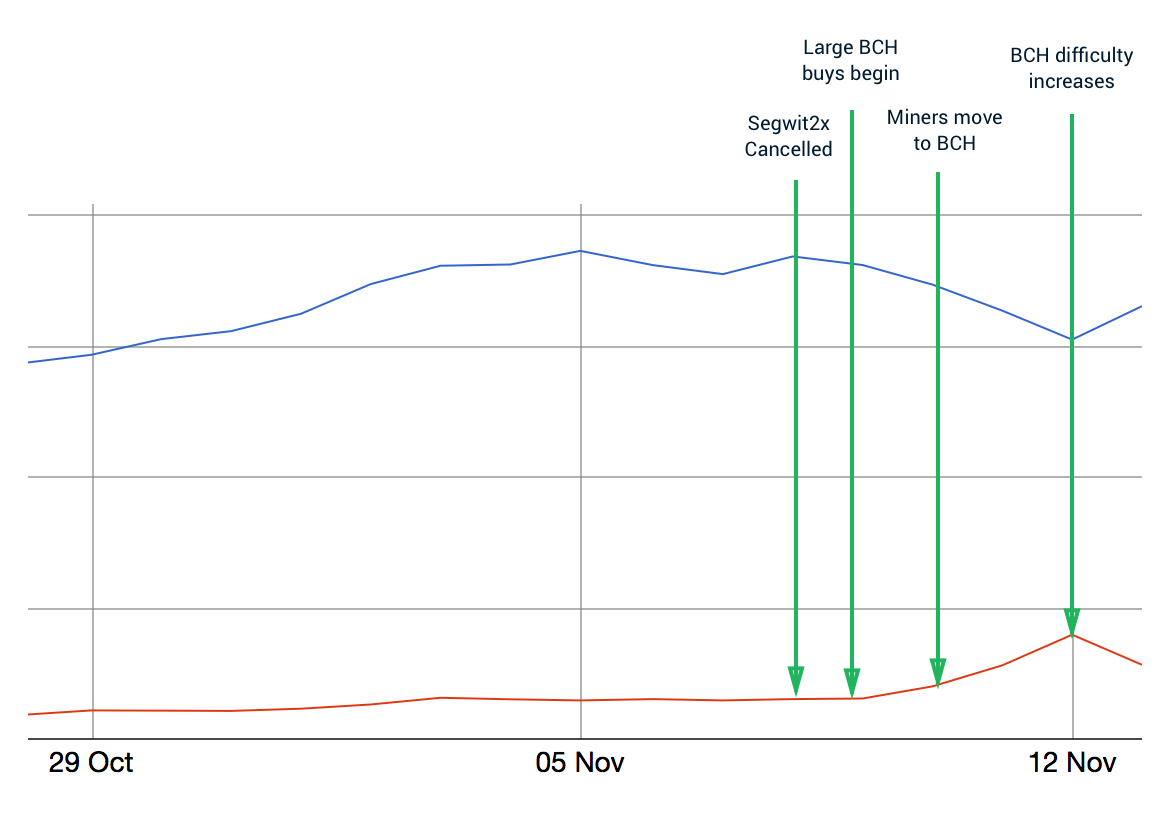

Bitcoin (BTC) crashed over the weekend and Bitcoin Cash (BCH) spiked in value causing a lot of confusion and panic in the community. BCH jumped from $600 -> $1,600 in just a few hours and BTC fell from a high of $7,700 to below $6,000 with volume looking to continue trending towards Bitcoin Cash.

– BCH

– BCH

– BTC

As I write this, Bitcoin has largely recovered and Bitcoin Cash has receded somewhat. The question is whether this is just wave 1 of a broader attack, or if the perfect storm scenario below is a one-off.

Setting the scene

- Bitcoin Cash launched on August 1 and has been fairly quiet

- Bitcoin transaction confirmation speed has been gradually reducing over the past few months (Bitcoin Cash fixes this with a larger block size)

- Bitcoin was set to introduce their competing fix to the confirmation speed challenge in the form of

Segwit2x, rollout of which was cancelled due to a lack of concensus - Bitcoin Cash mining difficulty was low due to small initial mining volume

- Bitcoin Cash mining difficulty change was set to occur on Sunday 11/12

The Trigger

The Segwit2x cancellation left Bitcoin in a weak position with many unsure of it’s future if it can’t create concensus for a life-saving change.

Several wallets with large amounts of Bitcoin began to sell and pump up Bitcoin Cash, increasing the value meaningfully. On Saturday, a large pool of Miners in China switched from mining Bitcoin (BTC) to mining Bitcoin Cash (BCH) due to the low difficulty and high value of BCH. This had two effects:

- Bitcoin transaction confirmation speeds massively reduced causing a transaction backlog (still in effect)

- Bitcoin Cash confidence & liquidity increased

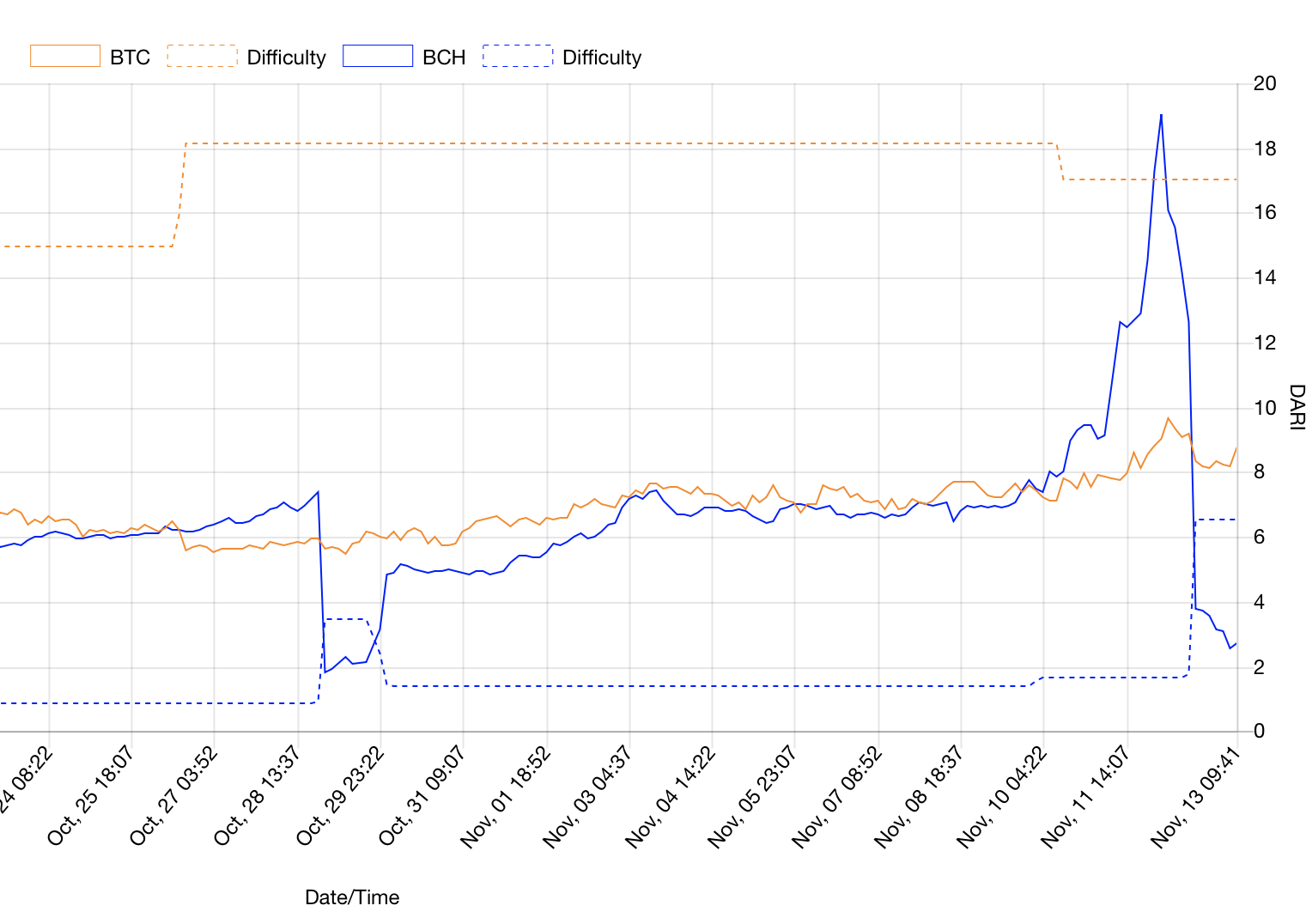

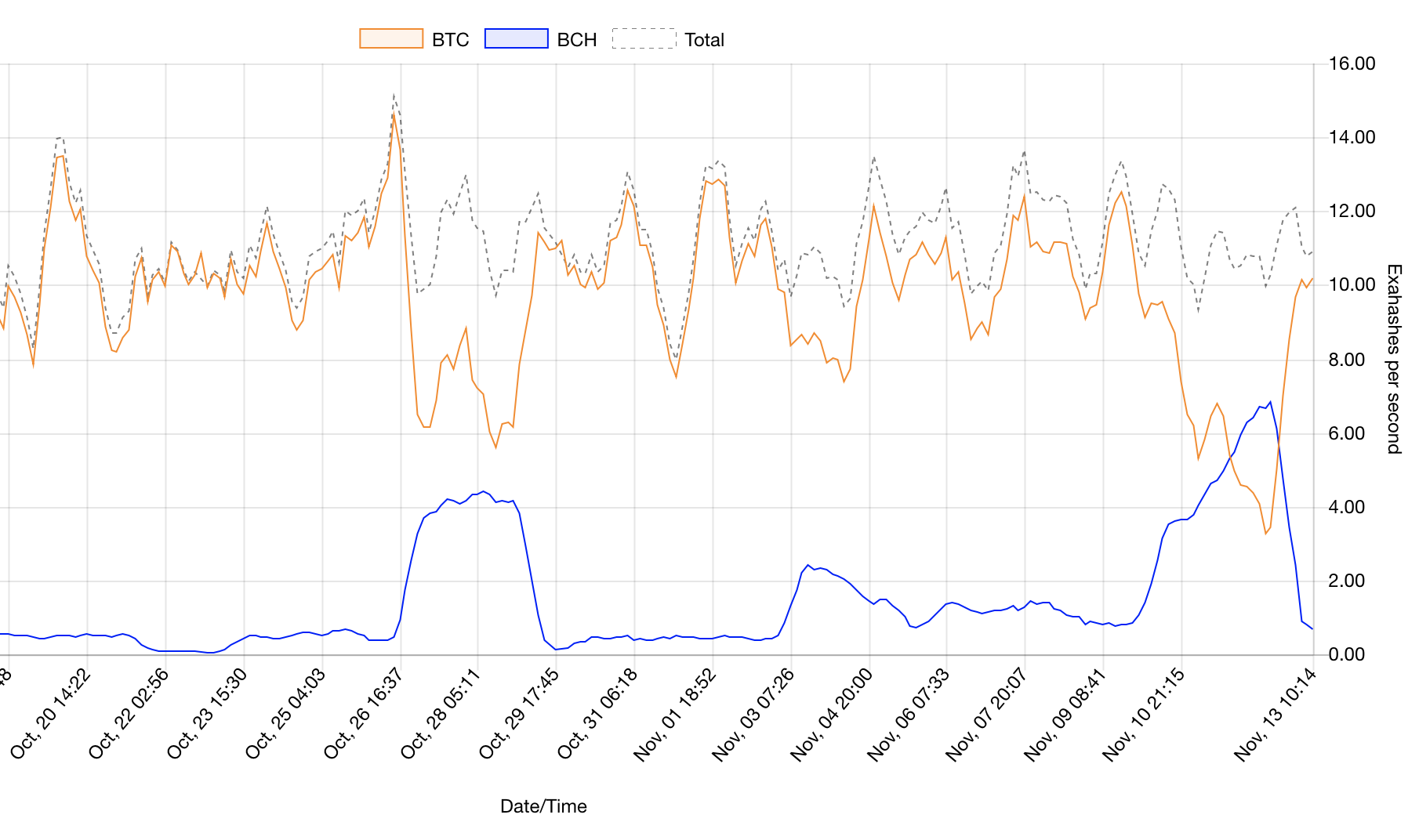

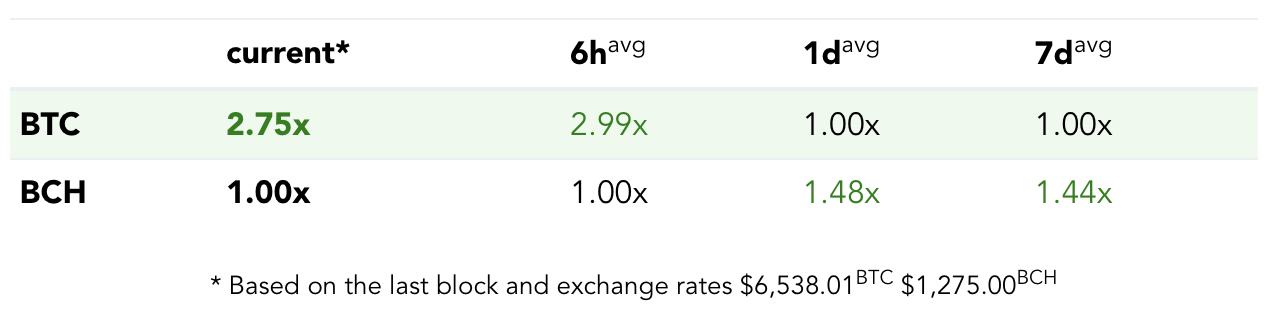

This in turn caused the value of Bitcoin Cash to increase more and with low mining difficulty, many more miners diverted to mining BCH. At it’s peak, mining BCH was more than twice as profitable as mining BTC and BCH had over twice the mining (and transaction confirmation) power of BTC.

Where the blue and orange lines cross, BCH overtakes BTC in mining capacity

Where the blue and orange lines cross, BCH overtakes BTC in mining capacity

Cleaning Up

On Sunday, Bitcoin Cash had a scheduled mining difficulty change, meaning that mining difficulty will correct for the amount of mining power that is currently in operation for BCH. This multiplied the difficulty of mining many times and cut profitabilty by a factor of 5.

This is a built-in self-protection mechanism to ensure some stability in the currency.

Mining BTC is now twice as profitable as mining BCH again and mining power is returning to BTC.

Theories

There are a lot of theories about how and why this happened, most revolve around two outstanding questions:

- Why did the mining power move so quickly and consistently to BCH?

- Who was dumping large amounts of BTC and buying HUGE amounts of BCH?

Theories include:

Market manipulation

The creators of Bitcoin Cash control a large amount of currency and through real purchases and washing were pumping up volume.

Market manipulation with state actors

Many theories center on China using this as an opportunity to gain a position of control over Bitcoin Cash

- Some theorize that the creators of Bitcoin Cash themselves colluded with the Chinese government

- The earlier ICO and Mining regulatory issues were largely an attempt to gain control over the miners

Let's talk about it.

Head on over to Twitter and let's talk more.

Find me at @chrismaddern.